Week 52:

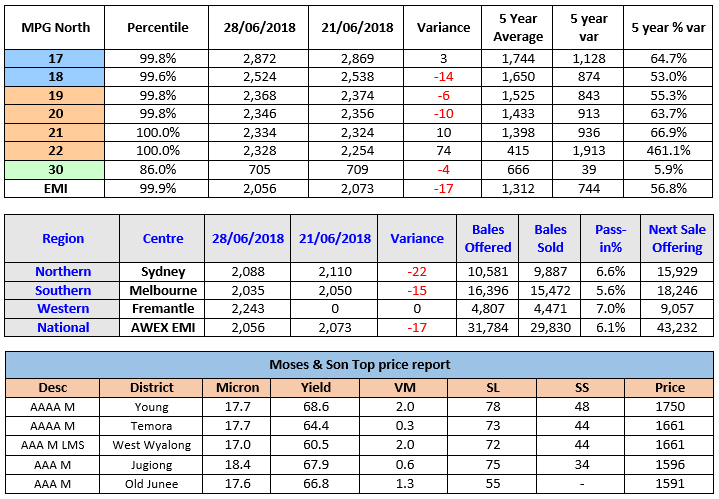

The AWEX EMI closed out the week (and the end of financial year) on 2056c – down 17c.

The feature of the final week of sales in the 2017-18 financial year was the slight retracement of last week’s extraordinary record price levels. Despite the extremely high price levels, the pass-in rate went up to 6.1%.

The Merino Fleece expressed the new lower price ideas very early in the offering, which were 30-40c below last week’s price levels (especially on poor style and specified wools), however as the sale progressed, so did the competition on the best style and specified lots which closed the week with only nominal losses. The two categories to buck the trend were the 17 MPG which closed up 3c, and the 21 MPG, up 10c. Fremantle also posted some healthy rises due to the western markets not selling last week, however, for reasons I cannot explain, the Western Merino MPG’s all finished well above their Eastern state equivalents.

Merino Skirtings seemed less affected with the best style VM and Specified lots maintaining last week’s levels.

Crossbreds lost between 5-10c with the 30μ and coarser least affected.

Cardings were also 5-10c cheaper with a very limited selection on offer this week.

Michael Avery from Southern Aurora Wool reports: Both the Auction market and the forwards steadied. Good opportunities still prevailed on the forwards with trades on the key 19.0 and 21.0 microns. 19.0 micron traded at solid levels out to October 2019. Growers being able to hedge between 2000 and 2050 for the New Year. 21.0 microns remain in high demand and traded to Christmas. New season prices ranged from 2100 to 2255. Late winter and early spring were in demand with August at 2255 and September 2205. The October to December interest ranged from 2100 to 2135 with the market factoring in the current supply squeeze and the lightly impact of demand relief from spot levels.

Commentary: Despite this small retraction, the weekly value of wool was $65.81m – which equates to an average bale value of $2206. Incredibly the season movement of 35% or 531c is the largest seasonal increase in the EMI since 2011. In the 2017/18 season, over 3.4 billion dollars’ worth of wool was sold to the trade – a $1925/bale average.

Australian Wool auctions continue for the next two weeks before the traditional seasonal 3 week break. At this point in time the South African Wool auctions and the New Zealand Wool offerings are in recess so the Australian Wool Auctions are the only substantial wool offerings in the world – therefore, the 43,232 bales rostered for next week’s sale should attract good competition as the remaining opportunities to secure wool before the three week recess are coming to close.

It was great to see some rainfalls across the state with some clients reporting 30-35mm. Whilst it did not rain sheep feed, it provides some light at the end of the meals on wheels regime. It’s a great time to be in sheep or wool. ~ Marty Moses