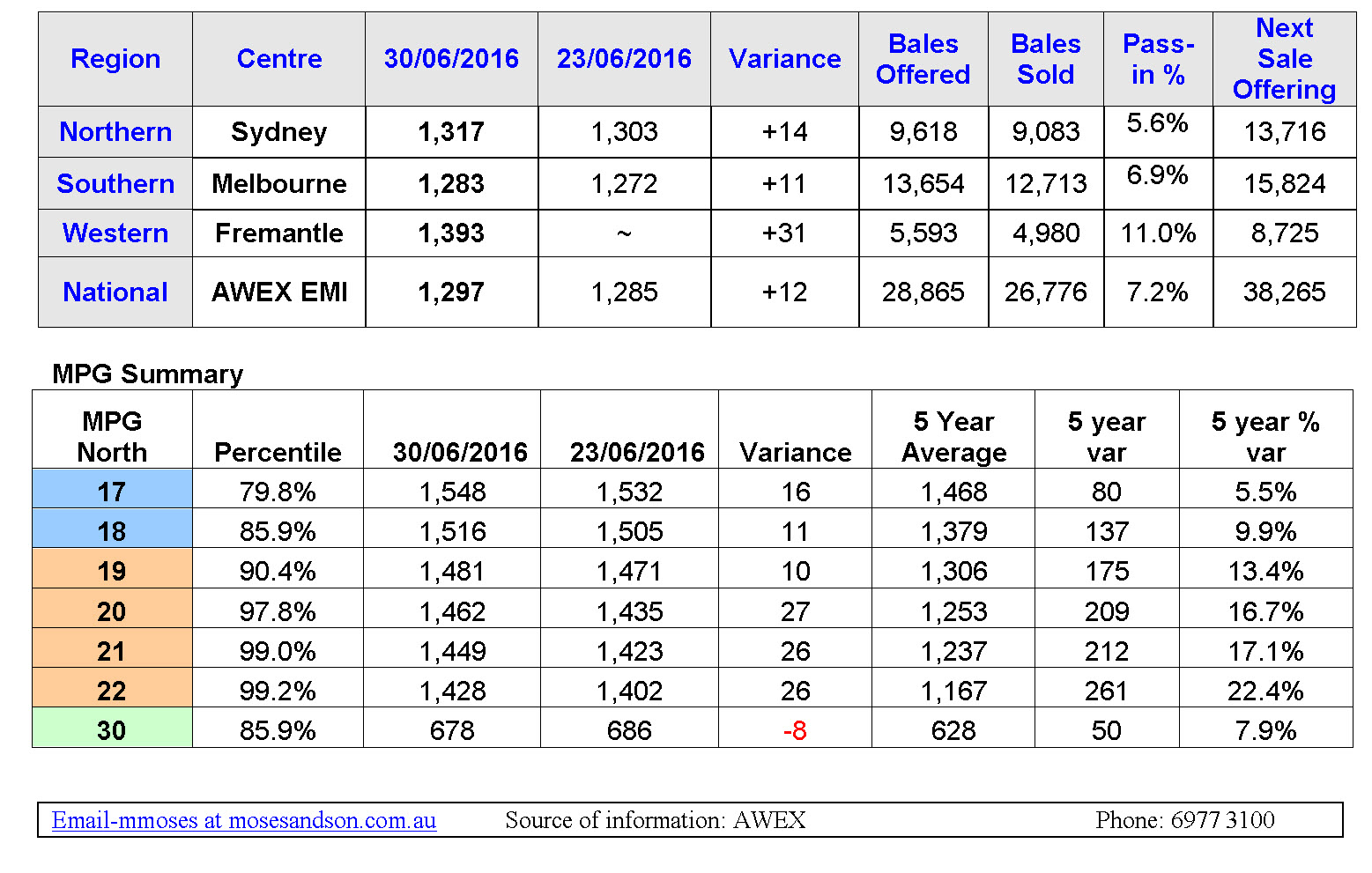

Wk 53 30/06/2016. The AWEX EMI reached the fiscal year-end on a positive note with a 14c rise taking it to 1297c, 7c short of the highest EOFY closing EMI on record. 28,865 bales were offered in three centres and resulted with a 93% clearance to the trade. Export interest was elevated as the AUD was slightly cheaper for the week against the greenback.

All Merino fleece categories continued to strengthen through to the last lot, with the 19.5-22 micron FNF types posting the strongest results. There is currently less than 20c clean between the 19 and 21 MPG’s and a mere 120c clean between the 17 and 22 MPG’s. This reflects the shortage of medium micron Merino wool production and despite the 7.3% reduction on wool production YOY whilst the supply of superfine and ultrafine wool continues to increase. Skirtings and cardings types held firm whilst Crossbred fell out of favour.

In light of the British referendum fiasco and its ensuing negative financial impact, Australian wool has preformed extremely well, however taking a step back from the past weeks global financial activities we would be extremely naïve to expect medium and long term immunity from this massive fiscal loss of share values. I believe that in time there may be a risk of some erosion in the confidence of the consumer in the northern hemisphere as a result of the British decision to exit the EU. It may be in the form of more cautious purchasing of stock from the retailers, or temporarily move away from luxury clothing purchase. Remember being an optimist does not grant you immunity from reality.

Either way the Forward Market has allowed some great opportunity into the early spring with August trading as high as 1400c this week; September at 1365c; and November at 1325c. History tells us that the average fall after a major price strike is 16% which would make the current Spring forward prices very attractive even at the 90th percentile band. Two week of sales remain before the season 3-week recess comes into play.

Can the wool market continue to hold or increase the current prices, well with 38,000 and 34,000 bale offerings for the next few weeks it will be hard to imagine the EMI closing too far below 1280c ~ Marty Moses