Week 48:

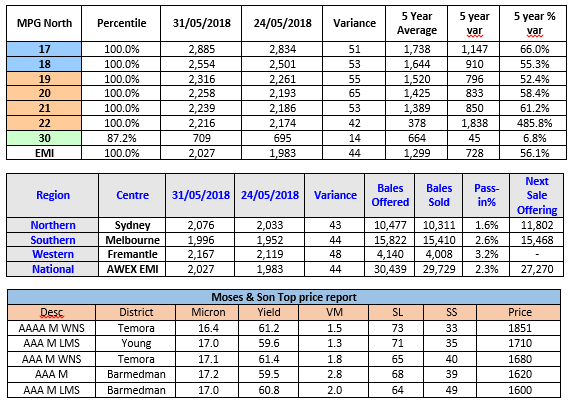

The AWEX EMI continued to break into new price territory, closing the week on 2027c – a weekly increase of 44c in AUD and 32c in USD terms (now on 1533c). A combination of the underlying forecast of low production, matched with the seasonal low point for available offerings and high demand, had buyers once again scrambling to achieve their purchasing schedules for the week.

From the 30,439 bales offered at auction this week, 97.7% cleared to the trade with record prices achieved in all of the merino MPG’s.

Merino Fleece attracted incredible buyer support adding between 40-80c across the range. Buyers seemingly ignoring low style, high VM and cotted/coloured discounts.

Merino Skirtings mirrored the fleece with rises measuring 40-80c, with keen attention on the <18 micron with low VM.

Crossbreds posted a mixed result with the sub 28 MPG posting 25-55c rises whilst the 30-32 MPG’s struggling to maintain last week’s levels.

Cardings also had a mixed week across the selling centres with Sydney and Fremantle posting 21-25c rises respectively, conversely Melbourne lost 12c.

After four consecutive large weekly rises, the EMI has now added 190c over the previous month – an increase of over 10%. This is the largest monthly percentage rise in the EMI in over five and half years and highlights the fundamentals reported over the past 18 months. The combination of low quantity in the pipeline (further reducing quickly), low production forecast and demand from the Top-maker through to retail and the consumer pose the question of what will be the circuit breaker for this amazing market phenomenon.

Next week 27,270 bales go to market in Australia and it also signals the last sale in South Africa for 8 weeks. It is hard to see the market doing anything negative given the market fundamentals we currently have in front of us. The catch phrase “It is a great time to be in sheep and wool” seems to be grossly understating the situation at the moment. This wool market surpasses any comparable experience I have witnessed in my 38 years in the trade.

~ Marty Moses