Week 51: 21/06/2018

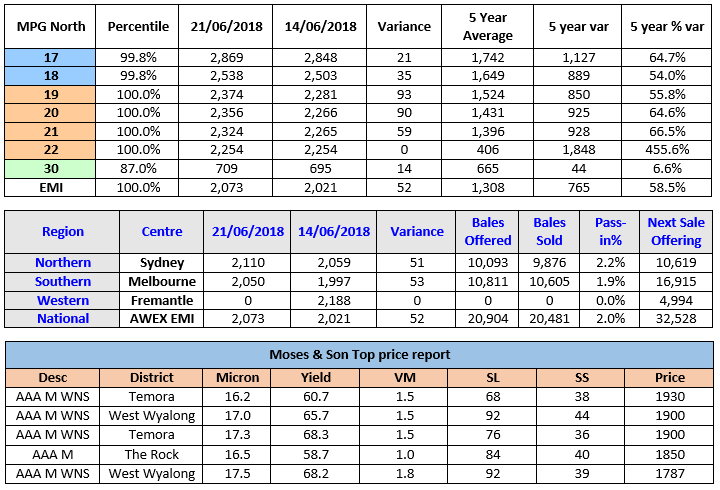

The AWEX EMI closed the week on 2073c – adding 52c at auction sales in Australia. Only 20,904 bales went under the hammer in Sydney and Melbourne and with no sale in Fremantle this week, the offering has been recorded the smallest Australian National offering in over 9 years. With the combination of a low national offering and rampaging buyer activity, it was not at all surprising that the pass in rate of just 2.0% was recorded.

Merino Fleece were keenly supported across the MPG’s, with rises of up to 100c recorded in Sydney on the 19.5 MPG and 90c on the 20 MPG. Price rises were less consistent in the 16 -17.5 MPGs as the quality was less consistent which is relatively normal at this time of the year, and further exacerbated by the spreading drought conditions on the south and east of the continent and its impact on reduced yield in the offering.

Merino Skirtings gained a further 20-30c.

Merino Cardings also pushed in to new price territory – pushing prices up another 20-30c.

Crossbred 26-28μ measured rises of up to 40c hitting new MPG highs, whilst the coarser micron categories struggled to maintain their previous levels.

The prices paid for the low volumes offered and this was definitely buoyed by the depreciating AUD which fell 2c over the week. In USD terms – the EMI fell 3c.

Michael Avery from SAW Forward Market Report: Another strong week for the spot market saw the forward markets trade at strong levels. Trading was sporadic as both buyers and sellers grappled with assessment of fair value. Exporters are facing a chorus of discontent from processors unable sell tops and yarns within dollars of replacement. Any forward sales uncovered have proved costly for the exporter but the alternative of taking stock brings incumbent risk and financing pressures. Against this backdrop is the current unrelenting grind upwards of a market faced with tight spot supply and the pressure to keep machinery running.

The dilemma facing growers today is trying to balance the market signals. While the market has risen constantly for almost two years, the forwards have remained in discount. With the benefit of hindsight, forward hedging has not delivered positive outcomes. The question now for sellers is not whether those signals are still inaccurate but whether the risk and the value of certain price outcomes for part of their production is too high to ignore.

The trade levels achieved this week probably go some of the way to answering that question. 21.0 trading 2100 plus in the early spring, 2000 cents in December and 1970 in February 2019 delivers strong guaranteed margins. We expect the tight supply conditions to hold the market through to the end of the season but these price levels cash flow constraints and increased demand destruction could deliver high volatility.

MerinoLink Conference: A huge number of sheep and wool Industry participants turned out in droves from all across Australia to attend the MerinoLink Annual Conference held in Goulburn, NSW on the 20th and 21st June.

With over 200 attending, MerinoLink Chairman, Rich Keniry, said that the general enthusiasm was demonstrated by the attendees leaving the farms and daily drought feeding regimes to take in the information from the impressive line-up of guest speakers over the two days. Rich Keniry commented that the feedback he has received was one of enthusiasm and encouragement for MerinoLink to continue delivering their message to their members. Rich continued “I am blown away at the attendees were so upbeat in their feedback about everything in the schedule, especially seeing we have experienced such a long dry period which has added enormous ongoing feed costs and labour requirements to many of these enterprises”. Congratulations to Rich and his MerinoLink Board for their dedication and vision for our wonderful sheep and wool industry.

Next week there will be 32,528 bales across all centres in Australia, which will be the final sale for the 2017/18 financial year, with two sales in Early July before the 3 week mid-year recess. I believe the next few weeks should deliver prices within a few percentage points of the current levels. An amazing time to be in sheep and wool.

~ Marty Moses