Week 45:

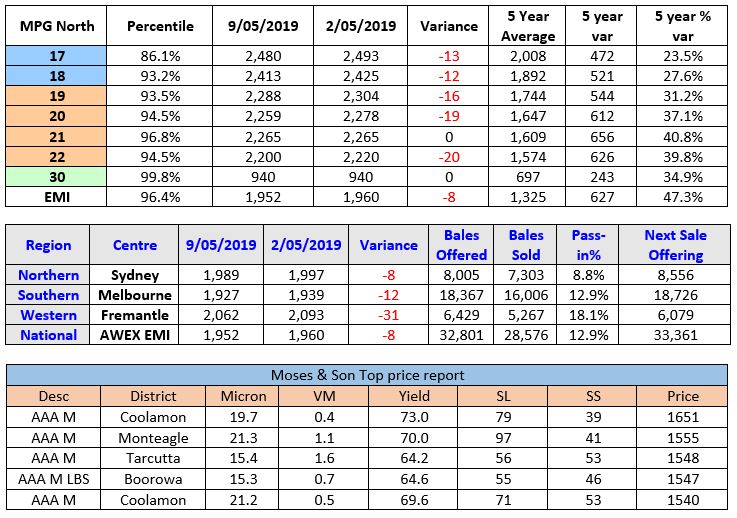

The AWEX EMI closed on 1952c – down 8c at auction sales in Australia this week. The 32,801 offering was a drop of 10,000 bales from last week’s sale and the commencement of the late autumn lower volumes projected to deliver record lows from now until August. A whopping 12.9% was passed in as growers expectations were not met in some cases, especially in the southern and western markets where 13% and 18% were the respective passed-in rates were.

Exporters opened the week cautiously, happy to fill their orders at a slightly reduced level in the Merino Fleece. The drought affected fleece types were selectively supported by two export companies at progressively diminishing levels however the best specified and good style, high yielding fleece lots commanded bullish attention, largely maintaining their previous week’s levels.

Merino Skirtings remained firm for the week with the best style skirtings at times exceeding the lower style skirting prices.

Crossbreds remained strong, especially the well classed lines with the 26-28μ adding 10-15c, pushing the 28 MPG into new record price territory.

Merino Cardings had a week of mixed results with Sydney posting fully firm results, Melbourne posted a slight increase of 7c and conversely Fremantle lost 25c – go figure?

Forward Price Report from Michael Avery (Southern Aurora Wool): Increased volumes went through the forward markets this week as risk mitigation was at the forefront of every one’s mind. Global markets reacted to increased tweeter induced tension in the China/USA trade talks with increased volatility.

Wool in particular had a mixed bag this week. Recently released export data showed improved volumes for March, leading to steading of the year to date decline to 13.7%. This is roughly in line with the production fall estimates. China took 80% of the exports for the month highlighting the importance of the current trade talks. Near and medium demand remains poor at these current price levels, leading to most merino qualities coming off 20 to 30 cents this week at auction. Forwards traded briskly with trades across most microns and maturities out to February 2021. The main focus was on the spring of 2020 and autumn 2021 where 85 tons traded between 2125 and 2155 in the 19.0 micron category. Fair value seemed to be achieved with growers wanting certainty of return for up to two years out at attractive margin levels. 2155 equates to the 75% price level of the last 4 years and the 90% level for the decade. Processors likewise are looking for some certainty of price to combat the volatility of recent times.

With demand remaining poor, we expect spot prices to continue to ease but tempered by the tight supply (weekly offering projected at 30 to 34,000 for the next month). Forward markets will likely follow suite and weaken slightly. Opportunities in the spring and into 2020 are likely present again next week and will be influenced global market sentiment.

The idiosyncrasies of the Autumn Wool Market normally presents many challenges with demand normally running its course and supply not always meeting the equilibrium. The national wool sales year on year are now 12.1% lower and I believe bolstered by a huge increase in shearing being brought forward, so despite what happens from here to the end of June for supply, I believe that there will still be further reductions in wool receipts into the next year. Just a return to normal yields could bring production back 3-5%. I expect this reduction in sheep and wool production will have substantial impact on the availability and hence the price volatility of the wool clip. The market intelligence is pretty strongly aimed at the price of wool falling however if, when and by how much is unknown so I point you to Michael Avery’s advice which states “it’s not the year to be living dangerously”. ~ Marty Moses