Week 01:

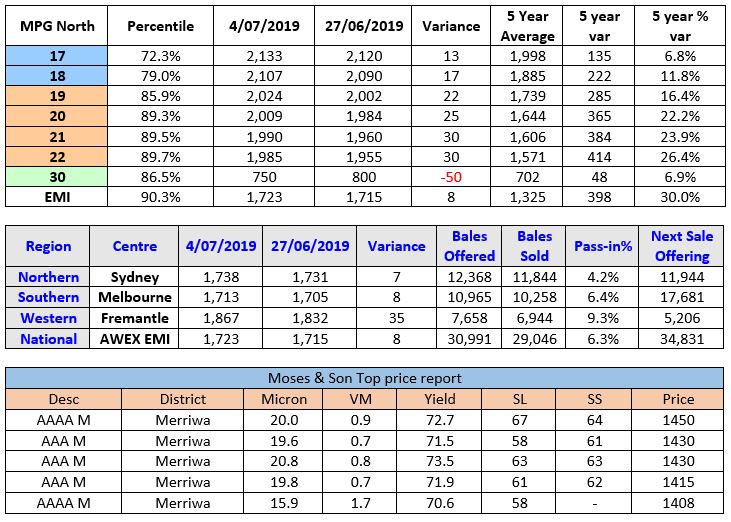

The AWEX EMI gained 8c, closing the week on 1723c at auction sales in Australia. Almost 94% of the 30,000 bale offering was cleared to the trade, and post-sale we witnessed a number of passed in lots being transacted as well as lots being sold presale on AuctionsPlus Wool. The sentiment may have gained some positivity from the previous weekend’s discussions between president Trump and XI Jinping, resulting in additional tariff increases (that had been signalled by Trump on Chinese imports into the US) being parked for the moment. This saw the opening lots on Wednesday find multiple companies bidding and this competition was able to halt the price falls and eventually turn the market direction from free fall to a (more healthy) rising close to the week.

Merino Fleece performed strongly in all centres with rises of 15-25c measured in the north, 20-30c experienced in the south and 30-45c added to the western region merino MPG’s. This rise was the break in the price slide we had to have.

Skirtings mimicked the fleece and gained momentum as the week progressed.

Cardings followed the leader, adding 18-20 to the MC in the eastern states, whilst the western MC bucked the positive trend and closed the week with a fall of 25c.

Crossbreds were as rare as hens teeth across Australia, with nominal quotes indicating a firm or slightly cheaper market in this category.

Forward Price Report from Michael Avery (Southern Aurora Wool): A better week all round for the wool market. A positive week at auction was pre-empted by more consistent bidding in the forward markets. A more constructive approach during the G20 trade meetings drew out some much-needed forward sales in the early spring. Processors continue to be more concerned about downstream demand than supply. Exporters were keen to cover sales for the second half of the year. This provided some improved hedging levels with October 19.0 micron trading up to 1925 and 21.0 micron to 1900 cents. As both microns had dropped 200 cents during June at auction, the forward discount demanded by processors of 80 to 100 below cash looks fair value for the four to six-month window.

Although we would all like to think the market is trying to form a base around the current level, the risk to the downside is still evident. Analyst continue to highlight the current poor global economic conditions, wool’s current overvalued position in relation to competing apparel fibres and the historic cyclic nature of the wool market as indicators to a continued decline in prices into the new year. When looking at a forward hedging strategy, the key factor is not trying to predict the outcome of the market in the future. It may be a factor in deciding the amount to hedge at certain levels, but the strategy should be relevant to all markets. The key is margin management and locking forward returns. If we look at wool data for the last five years, 21.0 micron traded over 1800 cents only 30% of the time and 1900 only 25% of the time. Those prices should deliver varying levels of strong, positive margins for a wool enterprise and can be locked in. Should we see a change in the global outlook or the stimulus in the spring sparked by the elusive uniform order to counteract the increased supply all well and good. A negative return on a hedge (if less than 50% of the clip) is a positive outcome. Should the downward trend continue, you are partial covered at positive margins. We hope to see a positive close the current wool season next week. This would give exporters an opportunity to sell into the early spring and summer at levels that will deliver good forward selling levels to growers.

Commentary: Next week, the market offers 34,831 bales across all selling centres, and compared to last year volumes at the same time was down 12,900 bales or 30%. June AWTA wool tested figures posted a similar result to back up the auction numbers. So as we look at next week and the three weeks of the recess with a negative trend in wool receipt, it would be fair to say that expected volumes will continue to trend down as much of NSW is still in the worst drought conditions in modern times. On the flip side we have seen trading conditions being described as the worst on record (in the modern era) therefore basic economic analysis tell us that we could be in for a wild ride with volatility being the name of the horse we have to ride off into the sunset. I’m sure you’ve all read Mike Avery’s column above which offers great advice for those who are willing to manage their price risk. ~ Marty Moses