Week 23:

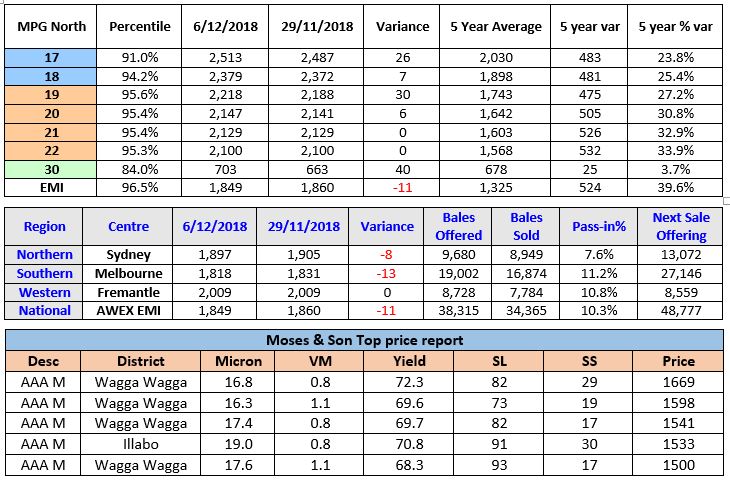

The AWEX EMI closed on 1849c – down 11c at Auction sales in Australia.

In the northern region, the Merino MPG’s increased in price whilst crossbred gave back most of the previous week’s substantial rises. Currency exchange weakened by .9% over the week with little effect on the markets direction as uncertain factors of both supply and demand took control.

Merino Fleece were generally 10-30c dearer, which was heavily driven by the best style and measured lots. The superfine offering fully captured the buyers’ attention, pushing prices up well in excess of the MPG movements.

Merino Skirtings followed the fleece trend with the low VM and best measured lots, finding the purchasers favour over the poorer and style heavy VM lots.

The Merino Cardings indicator checked this week after a 3 week price recovery period posting losses of between 7 and 20c across the selling centres with Locks, Crutchings and Stains falling 10-20c.

Crossbreds fell foul to the greatest buyer pressure. After posting substantial gains in the previous two weeks, 26μ gave back 115-130c whilst 28μ fell 96c and 30μ down 70c. These sharp falls resulted in a 20% pass in rate for the XB sector, dragging the national pass in rate up to 10.3%.

Forward Price Report from Michael Avery (Southern Aurora Wool): It was a week of mixed messages. Confidence rose on the news that tensions between USA and China have been put on hold. Globally commodity prices rose on the news but enthusiasm waned as the substance of the rhetoric was questioned. A weaker AUD is supporting spot prices but we are yet to see improvement in off shore prices. The forward market, although lacking in volume, presented opportunities again. Crossbred growers were again the beneficiary of strong forward bidding with 28.0 trading into the autumn at 900 cents and 30 micron 730 cents. This ended up being 40 to 50 cents above cash by auction close Thursday. This highlights the wisdom of having realistic targets in place to take advantage of the volatility and price rallies. Forward prices on the merinos improved with 21.0 micron achieving at 2100 for March having traded as low as 1980 last month when the spot auction corrected substantially. A short term base is in place with the forwards bid at 2050 and above out to June 2019. Discounts to cash have tighten particularly on the 21.0 microns. The first quarter of the year showing around a 1 to 1.5% discount and second quarter around 3%. The basis to the finer merinos remains tight with expectations that this will continue throughout the first half of next with the imbalance of supply favouring the coarser types. Long term levels one and two years out on the fine merinos (19.0 1930 for Nov 2019 and 1880 for Nov 2020)

Commentary: This week there was some interesting dynamics as the Large Chinese Indent buyers were heavily contested on almost every lot by local traders, who seem to portray a “buy at all cost” strategy. The supply alarm bells were certainly ringing loudly as the AWTA released their November kgs samples down 21.1% compared to the same period last year and a whopping 12.6% less Year on year for the season to date. When coupled with the sales figure through auction being down 18.5% in bales and 20.8% in clean kg terms, it places huge pressure on our processor customers to keep the machines running. Especially when we know that the current figures could be flattered by the progressively increasing numbers of sheep being shorn early and sold for slaughter as a result of the ongoing mother of all droughts.

From a Merino producers eyes, we are travelling into the last sale before the Christmas three week sale recess on a positive note with 48,777 bales on offer. I have heard more than once that this larger offering could elevate pressure on the EMI, however a quick comparison indicates that next week’s offering is 3,663 bales or 7% below the 5 year average of bales offered in the last sale before Christmas. With harvest drawing to an end and just two weeks remaining before Christmas Day, I would expect the sheep and wool discussion will re-enter the farm planning arena. With forward prices for 2019 and 2020 looking relatively healthy and the reduced supply of wool and sheep expected to remain at these levels for a while, I would say that wool producers have a very exciting time ahead of them. ~ Marty Moses