Week 29:

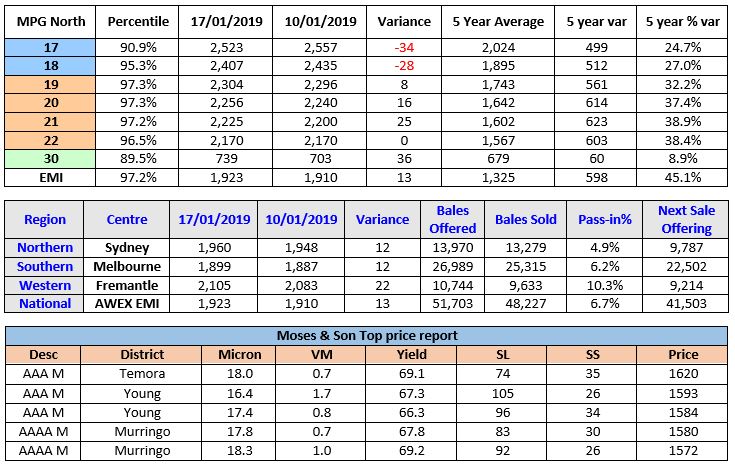

The AWEX EMI closed on 1923c – up 13c at auction sales in Australia this week. 51,703 bales went under the hammer and 93.3% cleared to the trade. With an offering of 51,703 bales, exporters were able to be slightly more selective, and as a result, each sale centres behaved independently throughout the week governed entirely by the quality of the selection.

Merino Fleece operated with less urgency on the sub 19μ categories, populated with drought affected lots which all lost between 10-35c, whilst the 19μ and broader MPG’s all added solid gains for the week – between 10-25c. The growing selection of low strength fine and superfine fleece types with low strength and high mid-break, attracted heavy discounts whilst the best strength and specified lots increased slightly on last week’s prices.

Merino Skirtings were generally 20-40c dearer and as in the fleece, the lots broader than 19μ attracted the best competition.

Crossbreds were the best performing sector for the week with the 26MPG adding 80c for the week whilst the 28 MPG increased by 55c. The coarser crossbreds maintained close proximity to last week’s prices.

Merino Carding varied between centres; the Northern and Western MC added 23c and 30c respectively whilst the southern MC fell 6c.

Next week, the market offering reduces substantially to 41,503 bales, as the recess receipt backlog begins to clear. It is also interesting to note the next month of sales will be all below 40,000 bales. Whilst the year on year comparison for bales offered is down an alarming 176,950 (-17.0%), the YOY sold comparison has a shortfall of 202,361 bales (-20.5%). How is this so, I can hear you ask? Well firstly, despite the EMI being 122c higher (+6.8%), the seasonal pass in rate has increased from 5.6% to 9.8%. The most likely reason for the increased pass in rate is the retracement of the superfine MPG’s caused by the increase of wool being produced in this category, courtesy of the mother of all droughts.

Supply will now become the key focus of the processing chain and as relayed by some exporters on numerous occasions, the Chinese processors have trouble believing wool production forecasts even though they are backed by solid actual data. I think we are in for a wild price ride in the near future, with many peaks and troughs- there is never a better time to lock in prices to secure these amazing price levels. Over $101.26M was sold this week which converts to ~$2100/bale average, and the year to date value of wool sold in Australia is now $1,748.44m – a bale average of $2221/bale. ~ Marty Moses