Week 30:

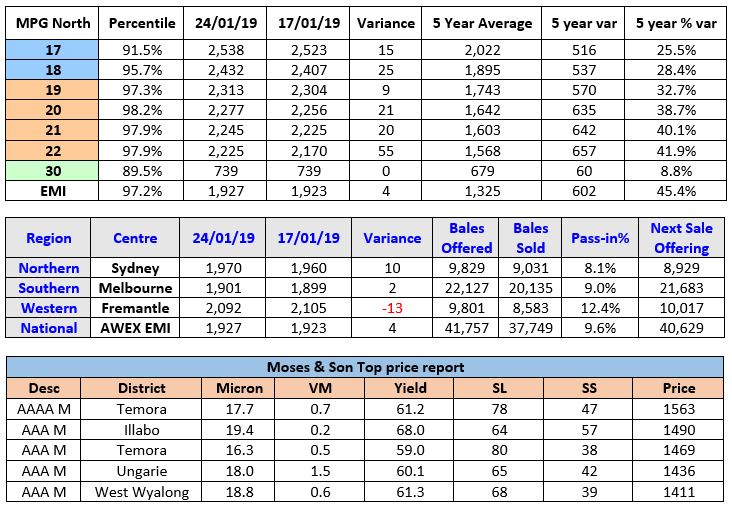

The AWEX EMI closed on 1927c – up 4c at auction sales in Australia this week. Once again, there were mixed results across the three Australian selling centres, with the Northern Market Indicator increasing by 10c, the Southern Market indicator adding just 2c, and the Western Market indicator falling by 13c. The 41,757 bale offering was met with good interest especially on sale lots that had favourable processing specifications.

Merino Fleece of best style strength and description, was met with good competition across all Northern

Market Merino MPG’s increasing by 9-27c. Some better measured merino prem wools also found some renewed interest, especially lots over 62mm.

Merino Skirtings followed the fleece categories with the low VM and best style well supported.

Crossbreds delivered mixed results this week after posting solid gains post-Christmas break. Wool finer than 26μ came under pressure with losses of 34-41c, whilst the support from 29-32μ was more upbeat delivering price rises of 10-20c.

Cardings experienced a three week price upswing, with all centres posting losses 16c in Sydney, 21c in Melbourne but -43c in Fremantle.

Forward Price Report from Michael Avery (Southern Aurora Wool): Forward markets were stagnant this week with very little interest coming from the grower side. Traders populated both sides of the market as they look to balance positions. Demand signals remain poor with exporters unable to sell at levels the tight supply conditions demand.

The spot auction remained firm across all merino types but fine crossbreds had mixed results. The only trading was in the late autumn/early winter with May and June executed at 2165 and 2160 respectively. Some improved bidding has come through in the spring with 19.0 bid to 2140 and 21.0 at 2010. Growers are justifiably cautious at these levels, having to deal with the ongoing drought and, with the benefit of hindsight, the fact than forward discounts that were unwarranted. Unfortunately we continue to be in a higher risk landscape. Macro-economic signals suggest a drop in commodity prices. Hopefully for wool this will be mitigated slightly by historically low supply and an Australian Dollar that at best will hold in the low seventies.

With our largest processor, China, reducing imports and consumer confidence low, the outlook is for higher volatility with a weakening bias.

Commentary: Next week’s just over 40,000 bales have been rostered for sale and may be the last sale over 40,000 until at least the post Easter sale. No doubt the topics that dominate the sale room halls have been supply and quality of the offering as the summer temperatures soar to the mid 40’s this Australia Day Weekend. The price offset for wool is still keeping many focussed on post drought opportunities, however there are many wool producers who have further destocked in the past month as the cost of feeding becomes too much for them to handle. Hedging at close to the market seems like a prudent option as we read the SAW report and what might be looming with our largest trading partners. ~ Marty Moses